NFTs and the Hype of Digital Ownership

NFTs have infiltrated the news. Despite not escaping the headlines, most of us still have no idea how NFTs work, why they’re important, or why they sell for millions upon millions of dollars. But with household brands creating and selling NFTs, it’s to the point where we can no longer ignore the frenzy surrounding them.

When tech and crypto experts talk about NFTs, it’s like they’re speaking another language. And that creates a dystopian-like mystery around NFTs, but we promise you, it isn’t that deep. Yes, it’s a vast, intimidating world to explore. But we’re here to demystify these digital assets and reframe the discussion about what people consider valuable.

The Basics of NFTS

NFT stands for “non-fungible token.”

Unless you’re an economist, you’ve probably never heard or used the word “fungible.” It’s certainly not a part of our everyday vocab. But “fungible” basically means that something is replaceable or interchangeable. Think of mass-produced goods. There are many copies, and it doesn’t matter which one you buy because they’re all the same.

When an item is “non-fungible,” it means it’s one of a kind. It cannot be replaced with anything. It is unique, and there are no other copies available. As a result, non-fungible items can have emotional or sentimental value because they are irreplaceable. This also makes them more expensive than fungible items.

For example, a pet is non-fungible. If your dog is stolen, getting another dog of the same breed and age won’t replace your beloved companion. A car, on the other hand, is fungible. If your car gets stolen, it can be replaced with the same model and year.

Every NFT is Unique

In the context of NFTs, “non-fungible” refers to an individual file. There is only one of them. This is where the “T” comes in. NFTs represent the ownership of a digital file, which are called tokens.

We don’t need to overcomplicate the concepts here. Let’s translate.

- Non-fungible: UNIQUE

- Token: DIGITAL FILE

- NFT: ONE OF A KIND DIGITAL FILE

In its most basic form, a token is a digital file that can be bought and sold. Except you can’t buy NFTs using cash. They’re purchased using cryptocurrency, which is part of the appeal.

When the purchase is complete, it’s recorded in the blockchain ledger, which is essentially a bank ledger for cryptocurrency. It’s a list of transactions, but everything is publicly recorded, and it cannot be altered. And that’s where the allure comes from.

Ownership data is made public. A buyer can purchase a digital file, and they have the crypto equivalent of a paper trail to prove it’s theirs. Anyone can see who owns an NFT and how much the buyer paid for it. In many ways, it’s a flex of disposable income and about bragging rights of owning a one-of-a-kind file.

The Value of an NFT is Determined by its Demand.

In general, NFTs are sold via digital auction. The more buyers want to own it, the more they’re willing to pay for it. The same is true for traditional artwork that is auctioned for private collectors.

An original work of art can’t be assigned a monetary value based on its quality or materials. Its value is determined by how much someone else wants it. And that’s why bidding makes the most sense for these transactions.

Beyond their initial sale, NFT creators receive royalty payments from secondary transactions. Each time an NFT gets resold, the original creator gets a cut of that money. And that’s how the people in the headlines are becoming millionaires with minimal effort.

Most NFTs are sold as artwork, whether a digital painting, an illustration, or a photograph. Songs, video game assets, and real-life club memberships can be tokenized.

However, there is no physical product, essentially making it a digital collectible that “can sell for tens-of-millions of dollars,” explained Heather Chen of Vice. “Buyers of NFTs own the original work—which can be anything from drawings to music, but most commonly digital art.”

Because everything is digital, people can still access the NFT after someone purchases it. They can download a copy of the digital art, but its owner is the only one with the certificate proving it’s theirs.

In many ways, buying an NFT is like purchasing a star. You have the certificate showing it’s yours, and that’s really it. Nothing else really happens. You can’t physically interact with the star, other than seeing it in the sky. And that’s free for everyone to do. So, what are you really paying for when you buy an NFT? Essentially, you’re paying for the experience of ownership.

“I think the simplest way to describe NFTs is as signed posters from your favorite artist. For instance, you like Madonna, and she has created a poster of her latest album. She just issued 100 copies of this poster with her signature on it, and it’s all serialized.So when you buy an NFT, you’re buying one of these 100 copies. Of course, on the internet, you can always download one copy. But that’s not the one with her signature, and it’s not the one with a serial number.”

– Mitchell Clark, News Writer at The Verge.

The Benefits of NFTs for Brands

- Create branded experiences

- Increase brand awareness

- Drive extra revenue through the initial sale

- Earn royalty payments from secondary sales

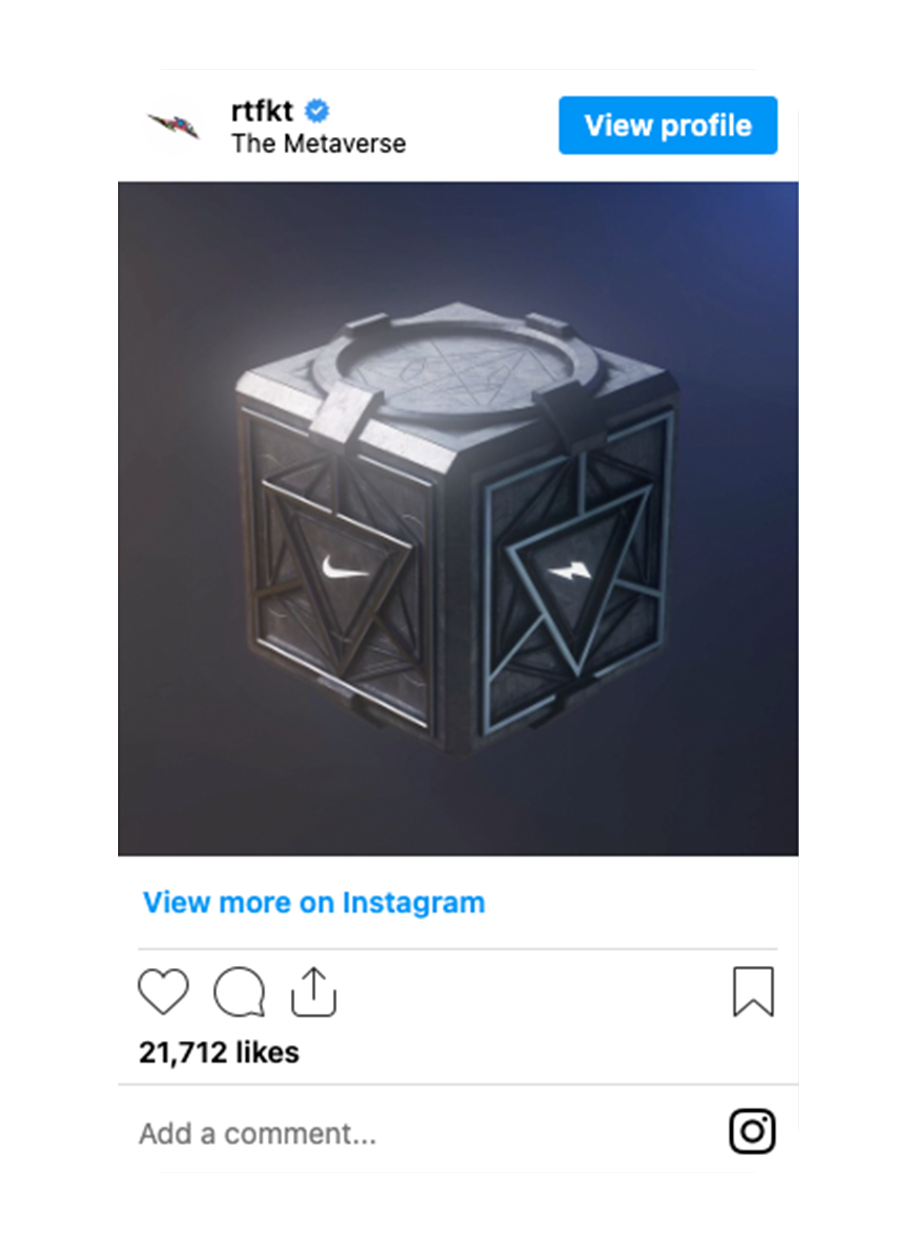

Household names are jumping on the trend. Nike released an NFT collection of dark metallic designs with a glowing Nike logo. The NBA has launched Top Shot, digital collectibles of iconic moments in basketball. Twitter CEO Jack Dorsey sold an NFT of his first-ever tweet for $2.9 million. Even Charmin is selling crypto art of toilet paper rolls.

“It’s trendy, it’s fun, and it’s cutting-edge technology that actually has the potential to redefine the way these brands do business and engage with their consumers,” said attorney Tal Lifshitz, who represents clients in high-stakes cryptocurrency disputes. “The more important question is, why are big brands not spending big money on NFTs?”

In February 2021, Taco Bell sold 25 tokenized designs on an NFT marketplace called Rarible. They launched the collection at $1 per piece, and they sold out in 30 minutes. Many of the pieces were resold, bringing thousands of dollars in royalties for their Live Más Scholarship program.

According to Jenny Stanley, content contributor at The Drum, Taco Bell’s “campaign not only proves that NFTs work well for pieces costing hundreds of thousands of dollars, but that it is also good for $1 gag purchases.”